The Government is extending £1m annual investment allowance cap for a further year, in a bid to stimulate investment.

The Annual Investment Allowance (AIA) offers 100% tax relief to businesses that need to purchase business equipment. It allows your business to deduct the total amount spent on qualifying equipment from your taxable profits.

On 1 January 2019, the AIA increased to £1 million. The £1 million figure now remains in place until 31 December 2021 and will revert back to its former £200,000 on 1 January 2022, so businesses now have more time.

Who Can Claim AIA?

The AIA is available for limited companies as well as individuals or sole proprietors and partnerships.

What can I buy?

The AIA allows you to write off most assets purchased to run your business. From printers to vans to diggers and lorries, almost all equipment and machinery purchases count.

What are the exceptions?

Cars or equipment and machinery you lease are not subject to AIA tax relief. You also cannot claim items you already owned and used for other reasons before employing them for business purposes.

How long have I got?

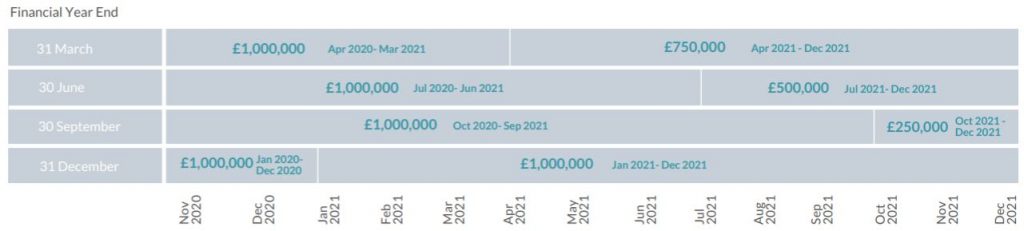

AIA can only be claimed in the period in which the qualifying purchase was made, and any unused balance of the AIA cannot be carried over into another accounting period. Therefore, as the allowance reverts back to £200,000 1 January 2022, businesses are encouraged to consider the timing of their purchases so as not to miss out on the opportunity of up to £1 million tax relief. The chart below illustrates the allocation by showing four different financial year-end companies and how vital it is to spend the right amount within the right periods in order to maximise the tax benefits.

How will your business make the most of the AIA allowance? For help and advice, get in touch with our tax team today: 01904 655202 or email enquiries@hghyork.co.uk.