HMRC’s Making Tax Digital switchover – the biggest change to VAT in decades – is on its way and with only a couple of months to go until the 1st April 2019 deadline, it’s essential that every business is fully prepared.

What does MTD mean for me?

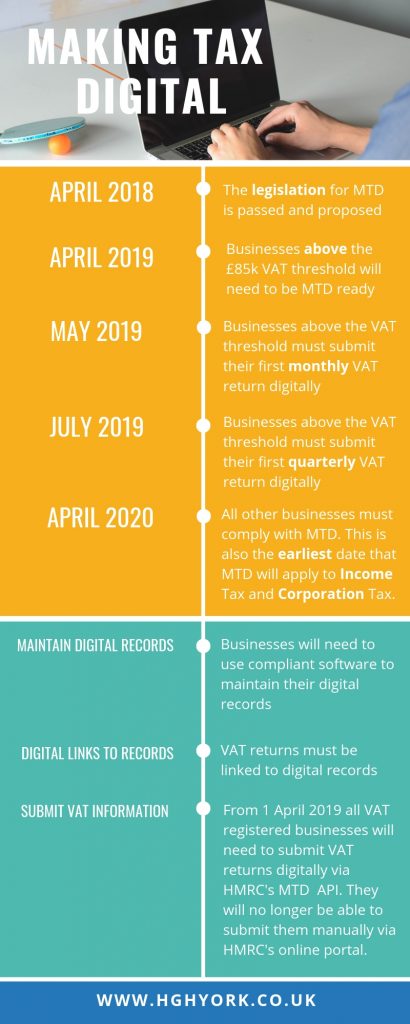

From 1 April 2019, all VAT-registered businesses with a turnover above £85,000 will have to keep digital records and upload these quarterly to HMRC through compatible Making Tax Digital compliant software.

Businesses will no longer be able to send their VAT information to HMRC via HMRC’s online portal. MTD will apply to VAT return periods that start on or after 1 April 2019, i.e. the VAT quarter ending 30 June 2019. HMRC states that ‘taxable turnover’ includes standard,reduced and zero-rated, but does not include exempt supplies or income outside the scope of VAT. MTD also applies to businesses that operate the Flat Rate Scheme.

Recent research has shown that over 40% of small-business owners are still not aware of Making Tax Digital MTD.

The recent research revealed the following:

- Over 20% of the business owners surveyed were not only unfamiliar with MTD but stated that they would only file digitally if it meant avoiding a financial penalty.

- Over 75% found the new MTD legislation challenging.

- Over ⅔ of those surveyed believed that finding the software would be difficult.

- Over 40% of respondents said they rely on their accountant for information on their taxes and business finances. Of these, most believe their accountant should play a key role in helping them.

- Worryingly for these businesses though, a significant number of accountants polled in the survey (around 30%) felt they knew little or nothing about MTD.

How do I comply?

If you are not using compatible software or using an outdated version or unsupported software, you should review upgrading or changing provider. As well as becoming compliant with MTD, this may also be a good opportunity to move to an accounting solution that brings improved efficiencies and gives you a better understanding of how the business is performing throughout the year.

You may continue to hold your records on a spreadsheet, if they are capable of transferring information to and from HMRC’s system digitally using an Application Programming Interface(API).

Are there any benefits of MTD for businesses?

Lots! Whilst MTD will bring significant change to some businesses, i.e. those that are currently using manual based accounting systems and doing paper based returns to HMRC, MTD will also bring significant benefits. These include:

- Improved bookkeeping and better accuracy of your invoice and receipt processing by using easy to use cloud accounting packages.

- Producing real-time accounts, so you no longer have to wait several months after your year-end to receive, what is by then, historical information.

- Improved business decision making because you’ll have more up to date and accurate financial information about your business.

- A better understanding of what your tax liabilities will be and therefore no nasty surprises. This will also help with the implementation of tax planning activities that could minimise your future tax bills.

- Paying your tax quarterly which may help the business’ cash flow position, rather than having to pay one or two large sums during the year.

How can HGH help me?

The move to MTD and the ‘digitisation of your accounts’ can sound very complex and confusing, but don’t worry we can help you. Whether you’re already using online accounting packages or if you are still producing paper receipts for your bookkeeper or accountant to process, we can help make this process as seamless as possible for you.

We are authorised partners of Xero but are happy to work with other cloud accounting software providers. We are already working with clients to move them across to whichever software package is the most appropriate for their business.

As well as setting you up on the relevant software package, we can provide initial and ongoing training to you and your staff. If you do not have the time or the know-how to do your own bookkeeping, we can undertake this task for you on a monthly or quarterly basis.

If you would like to speak to us about how we can help your business and get it ready for MTD, please contact us on 01904 655 202 or enquiries@hghyork.co.uk.