Payroll Changes for 2018-19

What changes affecting your payroll do you need to know about for 2018-19?

Legislation Payroll Changes for 2018-19 – An Introduction:

- Income Tax

- National Insurance

- Employment Allowance

- Termination Payments

- Student Loans

- Statutory Payments

- Minimum Wage

- Tax-Free Childcare Schemes

- Automatic Enrolment

Income Tax

Income Tax allowances

The basic personal allowance for the tax year commencing 6th April 2018 increases to £11,850 and the standard tax code is 1185L.

As a result, there will be a general uplift of tax codes with suffix ‘L’ which will increase by 35.

In addition to this, there is also a general uplift of marriage allowance tax codes with suffix ‘M’ increasing by 39 and suffix ‘N’ increasing by 31.

Individual tax codes for the year commencing 6th April 2018 were issued for some employees and employers should have received these by the end of last month.

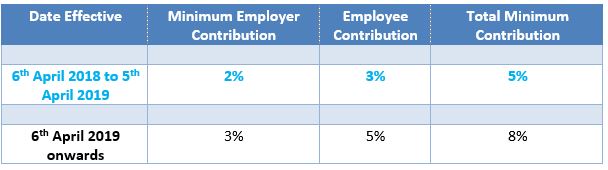

Income Tax bands and rates

The income tax rates and income tax bandwidths for the tax year starting 6th April 2018 are shown below:

National Insurance

National Insurance contributions (NICs) earnings limits and thresholds

- The main rate of primary Class 1 NICs remains unchanged at 12%

- The Class 1 secondary rate of NICs remains unchanged at 13.8%. This rate also applies to Class 1A and Class 1B NICs

- The additional rate of primary Class 1 NICs remains unchanged at 2%

- The Lower Earnings Limit increases to £116 per week/£503 per month

- Both the Primary Threshold (for employees) and the Secondary Threshold (for employers) increases to £162 per week/£702 per month

- The Upper Earnings Limit (UEL) increases to £892 per week/£3,863 per month

- The Upper Secondary Threshold (for employers with employees under 21) increases to £892 per week/£3,863 per month

- The Apprentice Upper Secondary Threshold (for employers with apprentices under 25) increases to £892 per week/£3,863 per month.

Employment Allowance

This will continue for all eligible businesses and charities in 2018-19 and the maximum value of the allowance will remain at £3,000 a year.

The allowance is claimed by offsetting amounts against the Class 1 Secondary National Insurance due in a pay period and is accounted for in the normal payroll process. Please note, the allowance cannot be offset against Class 1A or Class 1B National Insurance.

Termination Payments

With effect from 6th April 2018, certain payments made relating to termination of employment will change.

Payments in lieu of notice (PILON)

This type of payment, usually found in employment contracts, enables the employer to pay an individual the sum owed for a notice period, without the requirement for the individual to work and be employed during that notice period.

Under old rules, where an individual’s employment contract contained a PILON clause, any period of notice not worked should be subject to the usual PAYE deductions for tax and National Insurance as it would constitute earnings from employment. However, where an employee’s contract did not contain a PILON clause, any monies payable to the employee, up to the £30,000 threshold, may be paid free of any deductions.

Under new rules, any payment in lieu of notice will be treated as earnings and will now always be subject to PAYE deductions (tax and National Insurance) Whether the employee has a PILON clause in their contract or not is now irrelevant.

Student Loans

From 6th April 2018, the student loan repayment threshold for Plan 1 employees increases to £18,330. The Plan 2 threshold also increases to £25,000. Contributions will continue to be calculated at 9%.

For new employees with student loans who do not know their plan type, they can check online at www.studentloanrepayment.co.uk If they are unable to confirm their plan type, start making deductions using plan type 1 until you receive further instructions from HM Revenue & Customs.

Statutory Payments

Statutory Sick Pay (SSP)

From 6th April 2018, the rate of statutory sick pay increases from £89.35 to £92.05. To be entitled to SSP, employees will require average weekly earnings of at least £116.

Statutory Maternity Pay (SMP)

The rate of statutory maternity pay has also risen from £140.98 to £145.18 (or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate). The change in the SMP weekly rate is effective from Sunday 1st April 2018. To be entitled to SMP, the employee must have average weekly earnings of at least;

- £113 if baby is due on or before 14th July 2018

- £116 if baby is due on or after 15th July 2018

Statutory Paternity Pay (SPP) and Statutory Adoption Pay (SAP)

Also on 1st April 2018, the rates of statutory paternity pay and statutory adoption pay increased from £140.98 to £145.18 (or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate). Entitlement is per that of SMP as noted above.

Recovery of Statutory Payments

The general rate at which employers can recover Statutory Maternity, Paternity and Adoption Pay from HMRC will remain at 92%. Small employers (if you pay £45,000 or less in Class 1 National Insurance) will continue to recover 100% plus an additional compensation rate. The additional compensation rate will remain at 3%.

The Percentage Threshold Scheme (PTS) which allowed employers to reclaim SSP in certain circumstances, was abolished in April 2014.

Minimum Wage

From 1st April 2018, the government increased the National Minimum and National Living Wage.

The National Living Wage for those aged 25 and over increased from £7.50 to £7.83 per hour.

The National Minimum Wage rates also increased as follows:

- For workers aged 21 to 24, the rate increases from £7.05 to £7.38

- For workers aged 18 to 20, the rate increases from £5.60 to £5.90

- For workers aged 16 and 17, the rate increases from £4.05 to £4.20

- For apprentices under the age of 19 or those aged 19 and over who are in their first year of an apprenticeship, the rate increases from £3.50 to £3.70

The daily accommodation offset increases from £6.40 to £7.00.

For more information, please see our minimum wage article:

www.hghyork.co.uk/news/hgh-news/national-living-wage-update-2018

Tax-Free Childcare Schemes

Tax-free childcare is a new government scheme helping parents with the cost of childcare. Parents can determine eligibility online: www.gov.uk/help-with-childcare-costs/tax-free-childcare

Under the scheme, eligible parents open an online account provided by National Savings and Investments (NS&I) Payments are made to this account and for every £8 paid in, the government adds £2, subject to a maximum £2,000 a year per child, or £4,000 for disabled children.

Tax-free childcare will eventually replace the existing employer supported childcare or ‘childcare voucher’ scheme. This was set to be phased out from 6th April 2018, however, parliament voted on 14 March 2018 to extend the deadline for joining the childcare vouchers scheme by around six months. The exact date on which the scheme will now close to new applicants has not been announced yet, but it’s expected it’ll be around October this year.

Automatic Enrolment (AE)

Employer duties under automatic enrolment are reaching their conclusion and all existing employers have now passed their staging date. New employers from 1st October 2017 onwards have AE duties immediately, making pension planning a routine task associated with setting up a business and becoming an employer.

For employers who staged in 2015, further duties include re-enrolment tasks that must be carried out at the three-year anniversary of your staging date. This includes re-enrolling certain employees into a pension scheme that can be used for automatic enrolment, if they’re not already active members of one. Further information can be found at:

www.thepensionsregulator.gov.uk/reenrolment.aspx

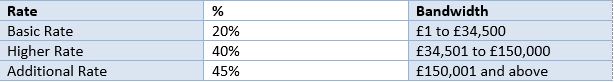

Contribution levels have also increased and came into effect from 6th April 2018. The table below summarises the changes:

For more information, please see our pension article:

www.hghyork.co.uk/news/hgh-news/changes-pension-contributions-6th-april-2018

Contact us

For more information about the contents in this article, please contact nigel.atkinson@hghyork.co.uk or clare.walker@hghyork.co.uk or call 01904 655202.