Top 10 Tips to Pension Planning

So you’re considering starting a pension? What do you need to consider and how can you make the most of the options available to you, so you can live the retirement you plan to?

Read on for our Top 10 tips to Pension Planning:

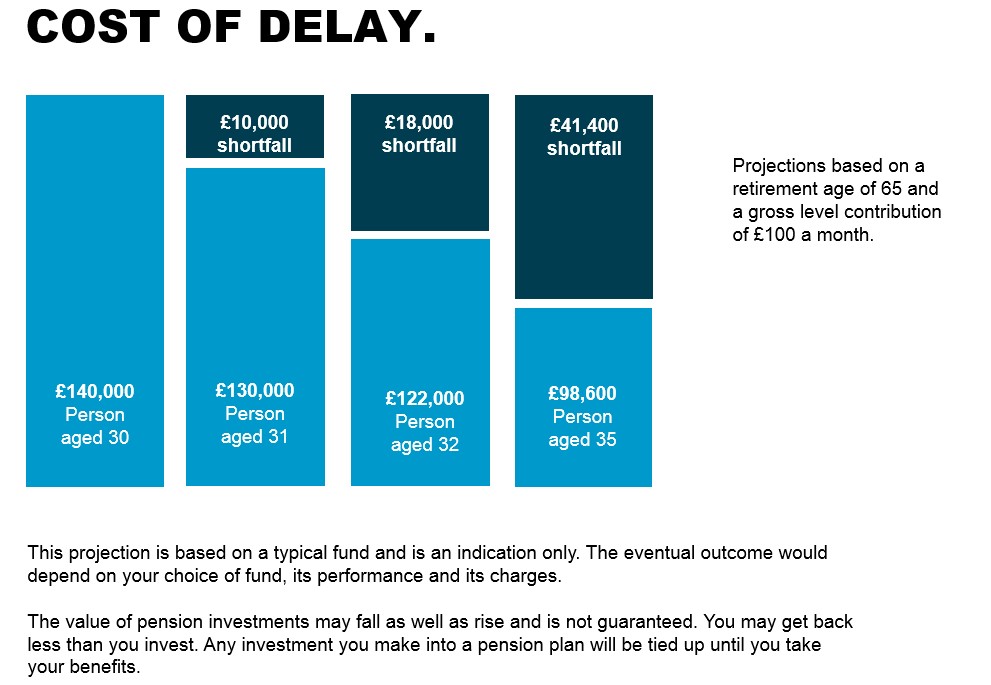

- It’s never too early or too late to start planning your pension. The sooner you start a pension, the better, as the cumulative impact adds up considerably over time. Making the decision to start one now is better than putting it off. Don’t procrastinate any longer!

Source: Legal and General

2. Set some time aside to think about when you’re going to retire and what level of income you will need to live comfortably. Be realistic about what your outgoings will be. A retirement budget planner such as the one available on the Money Advice Service is a good tool to help you to focus your thoughts. Being aware of your current and future budgets, sticking to them without fail and setting aside money for tomorrow will reap huge rewards.

3. Check your National Insurance contributions. The State Pension rules depend on you having 35 qualifying years of National Insurance Contributions. In reality, many people will not be eligible for the maximum amount of the new State Pension. It is important to check your State Pension record and National Insurance contribution history early; it may be possible to make up any gaps. A State Pension form can be requested by completing a BR19 form which is available at gov.uk, or by calling the government helpline on 0345 3000 168.

4. If you want to feel the benefit of a pension at retirement you need to feel the impact Paying off your debts before you reach retirement is essential. “If what you are saving is not hurting, it’s likely that you be will be disappointed with the outcome.” states Robert Reid, Readers Editor at Money Marketing.

5. Don’t opt out of your employer’s pension scheme without taking independent advice. Make the most of any company scheme available. Your employer will usually contribute and you’ll get tax relief on the contributions. Match the maximum contribution your employer will put in and save at this level. Over the long term, it is the contributions that really make the difference. Make sure that with every pay rise that you get, you increase your pension contributions inline. The employee (4%), your company (3%) and the government (1%) will also contribute to these schemes by 2018.

6. Pension planning is not just about property. Your house is a home, not an investment portfolio. Other investment options are available including ISAs which may offer you more flexibility. An independent financial adviser will be able to suggest the most suitable options for you.

7. Beware of Pension “Scams”. There are many companies around offering the opportunity to release money from your pension to make investments with attractive returns such as overseas investments. If it sounds too good to be true, it usually is too good to be true. Be careful if you have decided to cash in your policy as you could pay tax on the money. ALWAYS check before you do anything, that a company is registered with the Financial Conduct Authority.

8. It is a false economy not to see a financial adviser. You should regularly review your options throughout your life. As retirement approaches you’ll have a better idea of what your retirement income will look like and may need to increase your contributions to give your pension fund a boost. Find a trusted and hopefully, recommended financial adviser who will be able to advise you on contributions, provider, and how to draw your retirement income when the time comes.

9. It’s also a false economy to delay starting your pension. Back to point 1 on this one! Follow our guide above and TAKE ACTION on your pension planning TODAY. Time is money for financial peace of mind for your future.

10. Finally, keep active, eat your greens and enjoy what you do!

If you are looking for advice on your pension planning, whatever age you are, we offer a free initial consultation service to help advise you to make the right decisions for you and your family’s future. Contact us today or come and visit us at our York, Filey & Easingwold Offices.