York businesses join forces to offer local community-based asset management and advisory service

Posted: 20th Oct 2020 by Hunter Gee Holroyd HGH's News

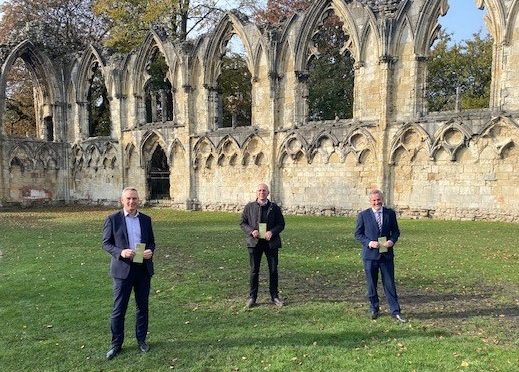

Leading York-based chartered accountancy and business advisory firm, Hunter Gee Holroyd, HGH Wealth Management Limited and Mole Valley Asset Management (MVAM), have joined forces to provide a community-focused investment and business advice package to local businesses and individuals. MVAM, a relationship-based investment company who offer innovative and bespoke investment services to private clients, SMEs and… Read more